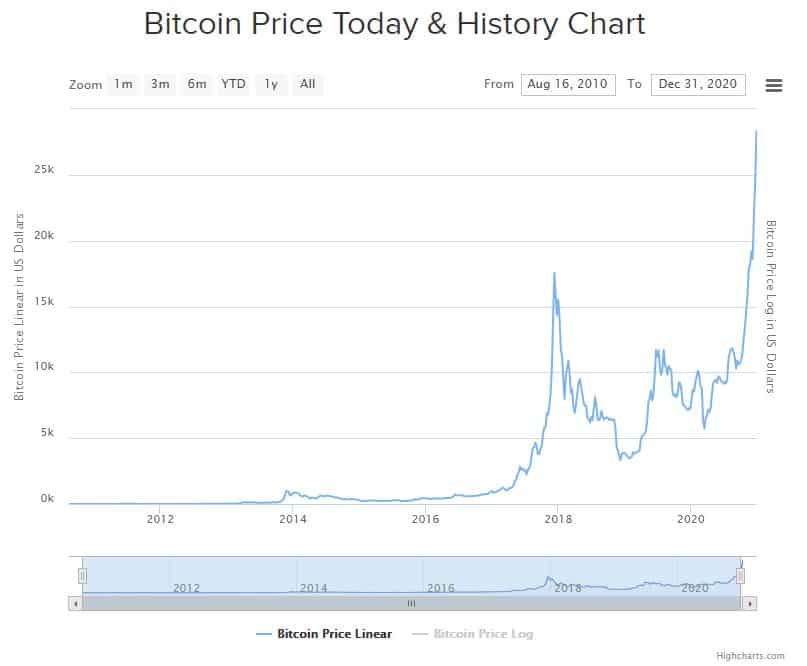

Bitcoin looks like a juicy federal and state revenue source for 2020. Based on the chart shown from the buybitcoinworldwide.com website below, there has been approximately $304 billion of capital appreciation in the cryptocurrency since January 1, 2020. It is pretty much a guess about what portion of that appreciation has been “realized” in 2020, which is why IRS needs taxpayers to self report:

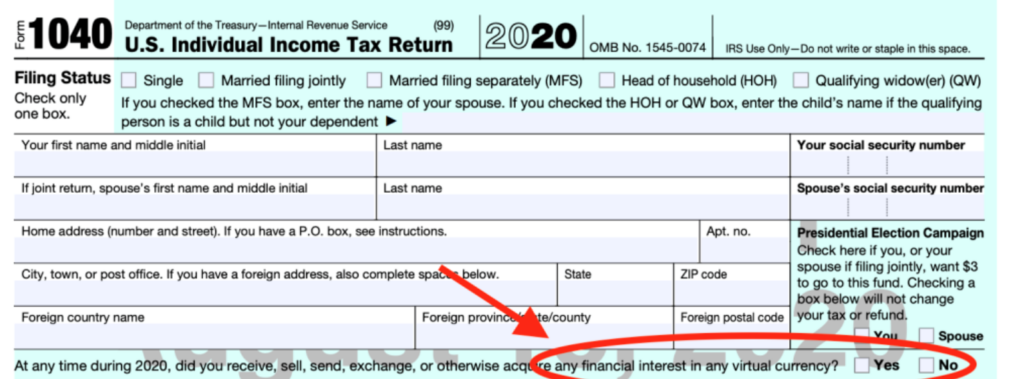

This all stems from the IRS position that Bitcoin (BTC), and all other forms of crypto are capital assets. So, it is a legitimate question to ensure that realizations are taxed. The IRS has clarified that simply transferring BTC between your personal wallets will not be considered a taxable event and not a reportable event in your 1040. It is like transferring custody of stocks from Ameritrade to Fidelity. Here is the 1040 question each of us will have to answer:

I think the issue is certainly about revenue, but it is also about discovering who owns Bitcoin. Early record keeping about knowing your customer was hit or miss. Starting at inception in 2010 many criminals, drug traffickers, and tax dodgers utilized BTC as a store of value and a medium of exchange, but it was a minor blip on global GDP. Bitcoin promised anonymity and freedom from a closed system where central banks controlled fiat currencies. Early adopters had to convert fiat to BTC and they all ended up in places like Coinbase which developed “fintech” trading platforms that bridged fiat and crypto.

By 2018, the dominant dealer in crypto was Coinbase, and it has announced an intention to file for a public offering of its shares in 2021. It will be interesting to see if there is disclosure about what percentage of Coinbase customers are actually “known” under banking investigation standards created by money laundering legislation enacted in 2013. I expect things were pretty lax from 2010 to 2017 when BTC first spiked to $20,000. During that period it was ridiculed by just about every leader of the fiat economy including JP Morgan’s CEO Jaime Dimon, who called it a “fraud” likening it to the “tulip bulbs”, a craze in Denmark in 1637 where a single rare tulip sold for more than a house. Mr. Dimon has since reversed his opinion. It is clear the leaders of the fiat regime have a lot to lose if there is a challenge to their implicit monopoly.

Revenue Opportunity For Feds and States?

The potential revenue prize for 2020 is probably pretty small. I tried to make a few assumptions about realized gains starting with the common belief that 10% of BTC has never traded. So that leaves 90% that may be trading of which it is estimated 5 % may be lost or destroyed.

Assume the best case for the taxman – that one third of the appreciation in Bitcoin from Jan 1, 2010 to December 31, 2020, was realized as a lump sum in 2020, and the cumulative basis is $0 (best case for Feds), and the effective federal tax rate was 25% (blend of ordinary and capital gains rates), and a 5 % state tax rate. The revenue potential for Feds might be $92 billion, and $18.5 billion for the states. That is not a lot of revenue compared to the potential tax receipts from the US stock market. Its value as of December 21, 2020, was in excess of $50 quadrillion and it appreciated by almost 13.5% in 2020. The big juicy tax target is not Bitcoin, especially because there are paltry records about who owns it and what gains were realized when.

But Bitcoin remains relevant as a hedge against failure of fiat currency systems all around the world. For that reason and the absolute ceiling on the amount of Bitcoin that can be created, it will continue to appreciate in my opinion.

Past performance is not indicative of future results. The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.