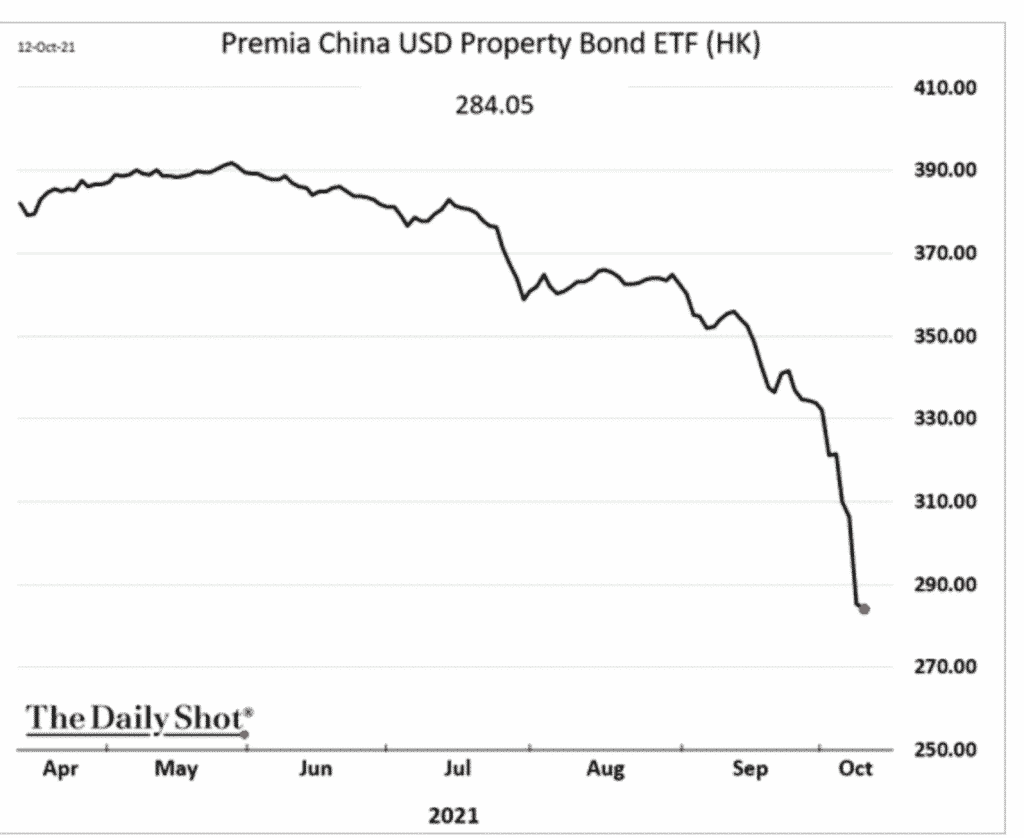

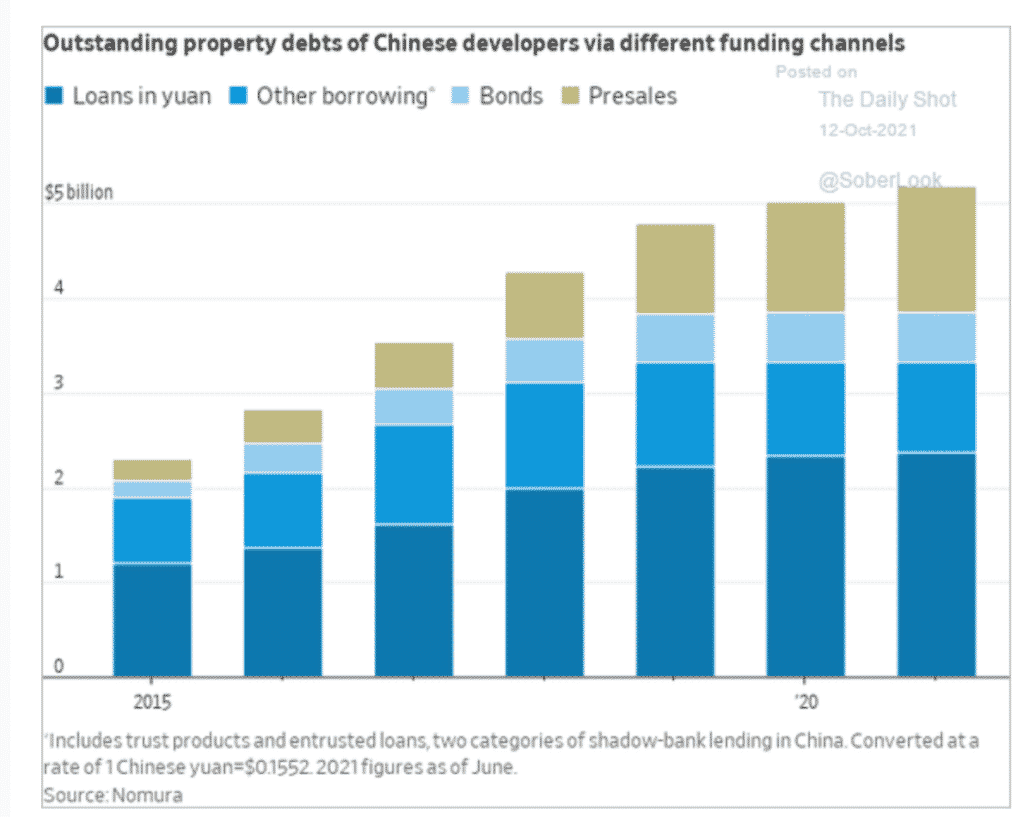

If you think the real estate excesses in the US housing markets in 2008 leading to the Big Recession were epic, the possible carnage from defaults in the debt based China property market are historic. According to an article in “The Wall Street Journal” written by Quentin Webb and Stella Yifan Xie on October 10, 2021, the debts are coming due and more than 40% are financed in international bond markets. Here is a chart from The Daily Shot published on October 12, 2021, showing a dramatic decline in the trading price of a China ETF comprised of property developer bonds:

Mr. Webb and Ms. Xie confirm the sector rout in their article and point to a high risk of default:

“Asia’s junk-bond markets suffered a wave of selling last week. On Friday, bonds from 24 of the 59 Chinese development companies in an ICE BofA index of Asian corporate dollar bonds were trading at yields of above 20%, levels that indicate high risk of default.”

Bigger and Biggest Describe The Potential Implosion

The problem is a combustible cocktail of sky high asking prices, reluctant international lenders, domestic policy constraints on more debt, and a concentration of fleeting paper wealth in China consumer accounts. The business model for how property is bought and sold is also different with a real risk of a Ponzi game pyramid.

Consumers Take The Development Risk

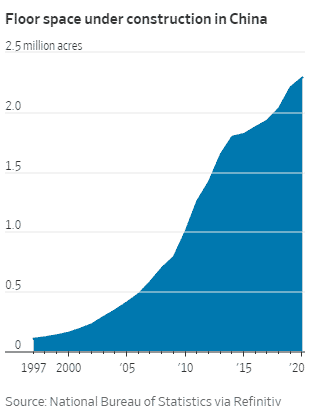

In China a developer routinely finances new construction with presales, and obtains interest free financing from hopeful owners — in essence the development risk is shifted to the prospective property owner. As long as values rise, everyone is happy. But recently the values have fallen and presales are under water. With more than 25% of China GDP being related to property development this swath appears too big to fail, but if China policy makers don’t draw a line in the sand, the carnage could become worse. Here is how Webb and Xie see the magnitude of the imbalance:

“Government statistics show about 1.6 million acres of residential floor space was under construction at the end of last year. That was equal to about 21,000 towers with the floor area of the Burj Khalifa in Dubai, the world’s tallest building.”

Presale owners are not the only group with a month of sleepless nights. According to Webb and Xie, the banks are also heavily concentrated in property development loans:

“ Outstanding property loans—primarily mortgages, but also loans to developers—accounted for 27% of China’s total $28.8 trillion in bank loans at the end of June, according to Moody’s Analytics.”

The China miracle has been built on a gargantuan economic platform with its consumers playing an outsized role, possibly without even understanding the risks. Webb and Xie compare Evergrande and America’s largest home builder, D.R. Horton as follows:

“The largest U.S. home builder by revenue, D.R. Horton Inc., reported $21.8 billion of assets at the end of June. Evergrande had some $369 billion. Its assets included vast land reserves and 345,000 unsold parking spaces.”

The bond market is signaling Evergrande’s high risk of default. Here is a chart from The Daily Shot on October 12, 2021, showing a dramatic loss of value in its high yield bond price;

Wealth Management Products To The Rescue

The final excess is hard to imagine, but China developers must have read “The Big Short” and realized if you cannot raise the capital from banks or project investors who won’t take the risk, you can still package them as high yield products available worldwide through High Yield ETFs. Doesn’t this remind you of Collateralized Loan Obligations in the Big Recession? When you put it all together the debt stack covers just about every corner of the Chinese economy:

Every Choice For China Is Horrible

Chinese policy makers have nothing but bad choices. If they allow insolvent property developers to refinance, the future debacle will just be worse and they will have reversed a country wide program of debt reduction called “three red lines.” If they let them fail, this might be five explosions bigger than Lehman Brothers directly affecting consumer wealth built largely on real estate. With meetings of the Communist Party slated for next year and Chairman Xi seeking a third term, politics may influence the policy response.

As we witnessed in the U.S. during the Big Recession those companies aligned with policy makers like Goldman Sachs and Morgan Stanley were spared when Lehman Brothers failed. Evergrande is similarly well connected and aligned with Chinese political goals. If it is spared, it will be politics trumping finance and yet another example of to big to fail enterprises.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.