“Tell Her No” was a classic rock hit from a British rock group The Zombies. The 1965 lyrics should be exhumed and applied to the runaway market appreciation in those public stocks where operating earnings do not even cover the annual interest expense:

“And if she should tell you come closer

And if she tempts you with her charms

Tell her no no no no no-no-no-no

No no no no no-no-no-no

No no no no no.”

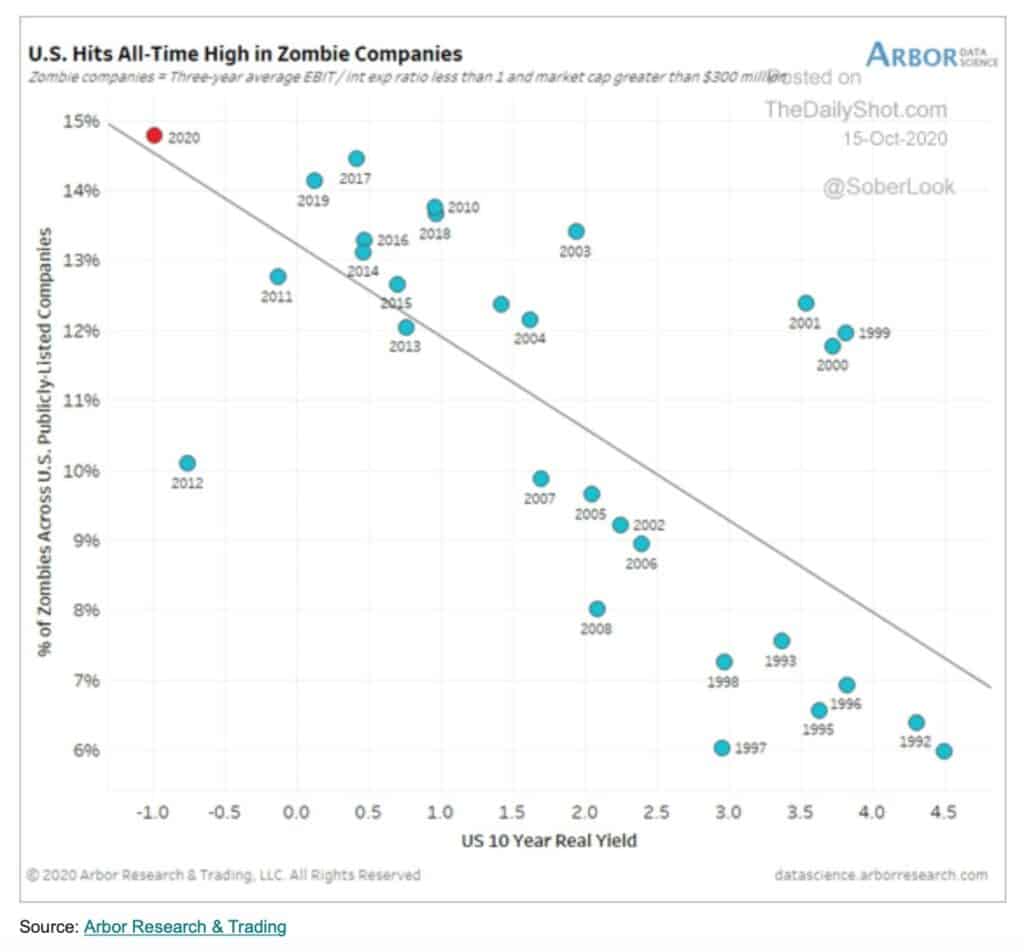

The big deal about Zombie stocks is they now account for almost 15% of the 3,000 companies with market capitalizations above $300 million according to research from Arbor Research and Trading as shown in this chart from “The Daily Blog”.

What shocked me about the chart was the X axis showing 10 Year Treasury “Real” Yield which means actual yield less inflation. At a time in 2020 when risk free money is returning nothing a whole swath of small cap investors may, unwittingly, be investing in companies that can’t even afford their interest expense which is near all time lows.

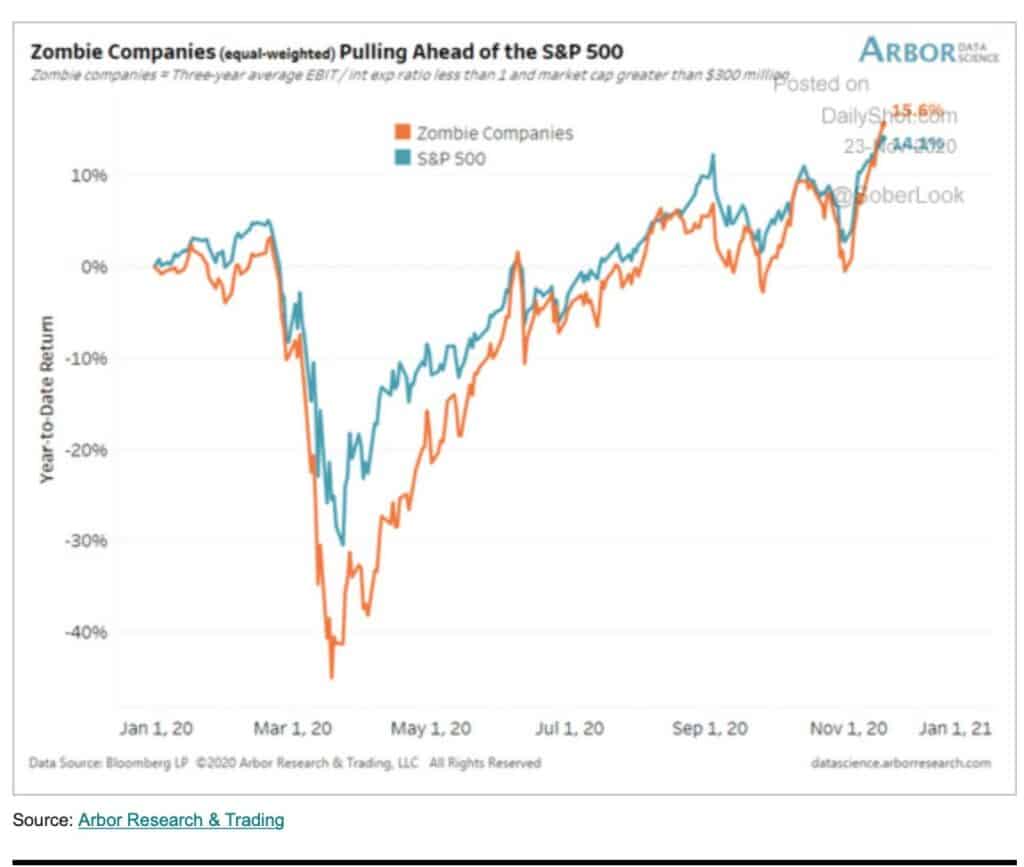

If these companies were being selected by a deep value turn around fund with the expectation a few of them could recapitalize themselves, deep value investors might be interested. What I think is happening, however, is the passive index funds are just including the zombies as component members and it is forcing their stock prices to a point where they now exceed healthy S&P 500companies as shown in the chart below:

A Playlist For Stocks

Do you want to exclude the zombies from your index fund ? How about excluding oil, coal, cigarette, and liquor stocks? How about an index with first time CEOs or CEO’s with a major equity ownership stake? Blackrock just paid $1Billion for Aperio which is a platform that allows customization of indexes.

As I understand it, Aperio will allow you to start with an index like The Russell 2000 (which is the smallest 2,000 of the 3,000 public companies by market capitalization). You could then get rid of the zombies and the offensive ESG components and, if you want some yield, all of the components that do not pay a dividend. This would be YOUR OWN separately managed account, sort of like a playlist for stocks; Taylor Swift but no Katy Perry.

More Active Management For 15 BPS !!!

I like the idea of customizing my index. No zombies. Levered free cash flow exceeds dividends by a comfortable margin. Debt to market cap is less than 50%. Revenues have grown at a compound growth rate exceeding 5%. Stock buy backs have not consumed more than 10% of free cash flow. The CEO and CFO team have been part of management for at least 10 years. My “Mac Index” will come with cheese, no lettuce or onions, but special sauce on a sesame seed bun all for the same price I can now get with most passive funds.

This is clearly why Blackrock paid $1 Billion for Aperio. The coming mass customization should be great for high net worth investors, but it could be highly disruptive for many incumbent managers who are not able to customize like BlackRock.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.