As investors begin to understand inflation, including the possibility it may become an impossible headwind for “real” returns, everyone wants to know what to do now. Responses to my last blog demonstrated a grudging acceptance inflation is going to last longer than a cup of coffee. So now everyone is searching for a winning formula.

I am not a financial advisor, and I don’t have any idea how to put together an inflation resistant portfolio. Bloomberg, Barrons, The Motley Fool and The Wall Street Journal have daily inflation advice ranging from the advisability of a 60/40 allocation of equity and fixed income, to inflation indexed Treasuries, real estate, private equity and commodities. Looking back over the last decade, one thing is for sure–getting a significant “real” return took some risk taking as quantitative easing depressed yields on bonds and savings.

Risk On Peppered With Leverage

As a consequence, investors have been migrating from low leverage, low risk (high quality bonds, deep value equity opportunities, well capitalized dividend paying stocks, liquid cash equivalents, gold, silver and platinum and well capitalized homes with fixed rate mortgages), to higher risk with higher expected returns, often utilizing leverage and, sometimes, leverage on leverage (small “zombie” stocks, high yield bonds, SPACs, crypto, meme stocks, Non Fungible Tokens, hedge funds, private equity, private real estate and emerging markets).

Investment advisors call this the “risk on” trade. Almost universally, the risk on trade has worked for popular asset classes utilizing leverage like zombie stocks, high yield bonds, private equity and all forms of real estate. Meanwhile in a low return environment conservative, unleveraged portfolios have struggled to produce any “real” return even when inflation was less than 2%. Value investors have been underperforming.

Inflation Is Challenging Winning Strategies

That was before inflation threatened stability of variable rate consumer debt which has remained low for as long as I can remember. That variable rate debt is typical for margin accounts, credit card debt, some mortgages, and bank loans and it can move up as fast as the lender wants to change its base rate.

If you have been using a margin loan from your broker to buy a public stock with an attractive dividend, you may find your margin interest expense can double over a very short period and wipe out that attractive dividend yield.

Private Equity and Private Real Estate Have A Slightly Different Model

There is no question valuations for both these asset classes have risen and the willingness of banks and other lenders to provide fixed rate, low interest loans as a larger percentage of the capital structure is certainly the norm for the largest swath of private equity. Here is a summary from “Almost Daily Grants” on October 25, 2021 “Loan and Behold” that reviews the largest transactions and sponsors and addresses the massively leveraged capital structures for the mega deals:

“Higher prices invite more aggressive capital structures: Median LBO debt to Ebitda ratios reached a record 7.5 times Ebitda year-to-date through June 30, up from 6.1 times Ebitda in 2007. Even that jump in purchase prices and leverage ratios may be understated, thanks to increasingly-common Ebitda add-backs (or credit for hypothetical future cost savings). An analysis from S&P Global last year found that reported net leverage among 2017 vintage deals stood 2.8 turns higher than management had projected by the end of 2018, and 3.3 turns higher as of Dec. 31, 2019.”

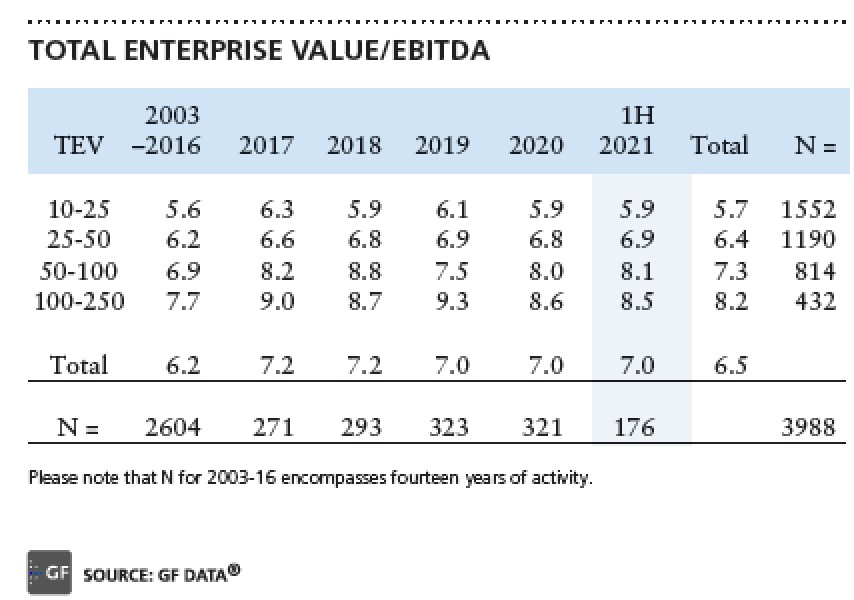

More typical are middle market and lower middle market transactions where the purchase prices are more rational and the capital structures much more conservative. Here is recent data from GF Data about the smaller transaction universe.

Fixed Rate Debt Is Antidote For Inflation

In general, private equity and leveraged real estate are prime examples of “risk on” asset classes with important business model advantages in inflationary times.

First, businesses and landlords are usually able to pass on inflation to their customers and tenants in the form of persistent product or service price increases or increased rents. Next, they mostly have fixed interest rate capital structures with a fixed principal amount to be repaid. In some cases, lower market PE firms are required to swap out a portion of the capital structure into a variable rate, but in general most of the capital structure is fixed rate.

Inflation allows them to repay fixed obligations with money that gets cheaper in buying power every year. They also have capital reserved for add on investments and additional equity company support that can be utilized to shore up balance sheets in a time of distress like the last 24 months. This may be allowing them to outlast the inflationary cycle and reorganize bank debt.

Secondary Market For Investor Defaults

There is also a quite efficient secondary market for private equity and real estate investors who have borrowed at a variable rate to buy into these asset classes and who may be unable to meet capital calls in a rising rate environment. There may be a way to substitute a new owner without total loss of equity. And the PE fund gets a more reliable source of professional equity.

Changing Mindset Is Critical

The inflation scenario challenges us all to learn a new way of thinking about how to utilize leverage. Since the historic pattern is for interest rates to rise to match inflation, we should all be concerned about variable rate debt in inflationary times. It is not just too much debt, but now also about how interest rates are structured.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.