The good news is the “pork” panacea from ARPA provides about 100 times more than anyone needs. This should spur a line up of organizations trying to fund their WANTS from real and phony non-profits, to school systems and public venues and parks. Do you think the money may end up in some strange places?

As local responsibility for balancing budgets and spending within means goes awry, a whole new round of immediate gratification will likely ensue. States and local governments are being conditioned to spend beyond their means and join the rest of the world in a big, unfunded post pandemic party financed by a permanent drag on all future generations.

Coronavirus Relievers Are Like the Dodgers Bullpen

So far the Coronavirus relief has been like watching the Los Angeles Dodgers relief corps. Each successive reliever is bigger, stronger and more highly paid than the previous one, and they never seem to run out. Here is a summary from The Peter G. Peterson Foundation written on March 15, 2021, in an article titled “Here Is Everything The Federal Government Has Done To Respond To The Coronavirus So Far” Author WARNING: Tighten your jaw before viewing:

The irony of the endless aid is the worldwide supply chain is too dysfunctional to allow the money to end up spurring a recovery. Like the port of Los Angeles, the money just accumulates waiting for a chance to be unloaded. Meanwhile the mismatch of demand and supply is creating real inflation. Those who think we are in the 8th inning of the inflation game may be the same policy makers who think just sending more aid will jump start a recovery. Most disturbing is the endless cash is hindering a full employment workforce. Every small business is trying to hire but cannot compete with the printing press that, like the horn of plenty, never runs out. Unintended and intended consequences will be the story in 2022 and beyond.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.

When I was notified last week by our friends at municipal bond firm Wasmer Schroeder that Moody’s had given Illinois a credit rating upgrade, I could not believe it. This is a state with one of the highest unfunded public pension ratios in the country, and the only state to borrow from The Federal Reserve to fund a backlog of unpaid bills. Getting a credit improvement for Illinois bonds was unthinkable before Covid-19 tethered the irrepressible federal money machine to states, local governments, territories and tribal governments under The American Rescue Plan.

The American Rescue Plan Act (“ARPA”) allocated Illinois $8.1 billion at the state level, and $5.9 billion at the city level to help it recover from the expected devastations of Covid-19. Those devastations, however, appear to be concentrated in energy states like North Dakota and Alaska, and tourism states like Florida, Nevada and Hawaii. States with high unemployment have also seen their unemployment benefit funds run to zero. Nonetheless, Illinois is only projected to have a small revenue deficit for 2020.

Pretty Much No Strings Attached

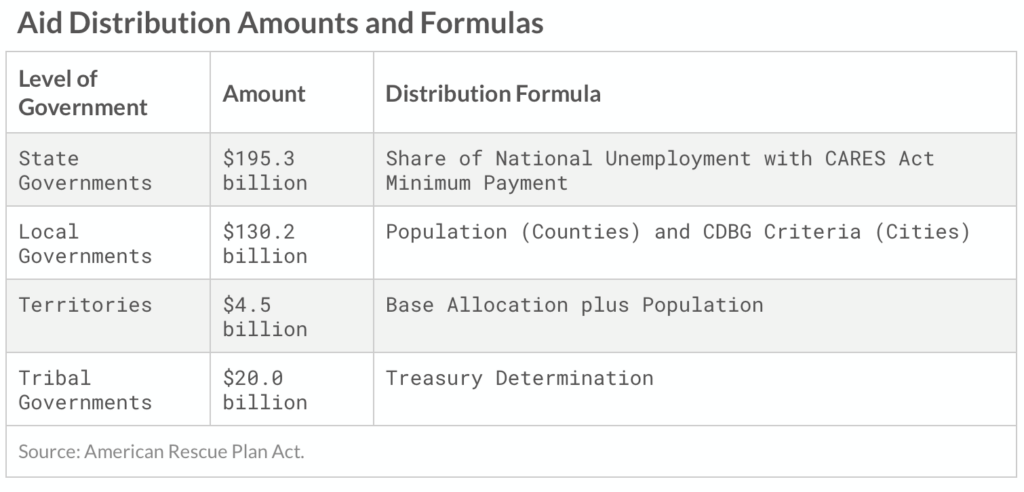

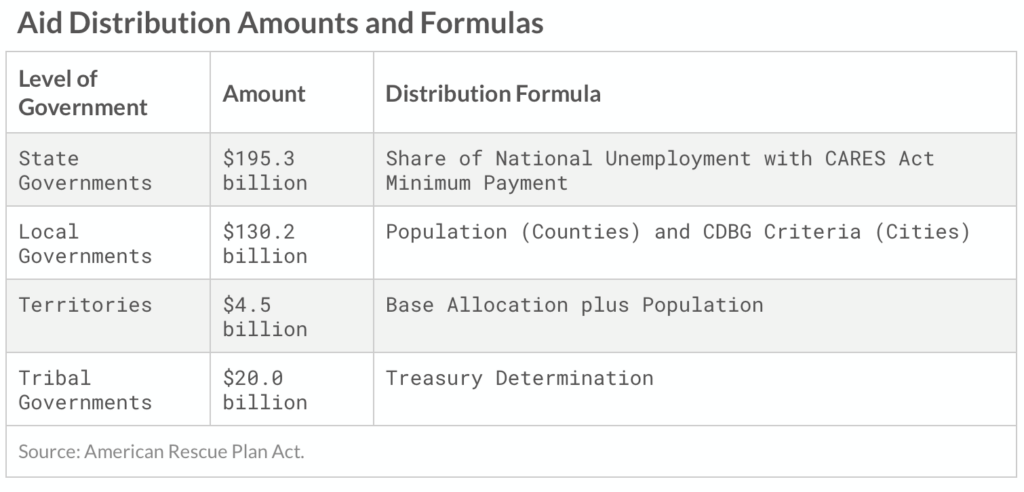

Under The American Rescue Plan enacted March 11, 2021, with bi-partisan support states ($195 billion), local governments ($130 billion), territories ($4.5 billion) and tribal governments ($20 billion), will receive $350 billion in highly unstructured funding. Those funds are not earmarked, and there will be massive latitude to spend the money on just about anything other than direct contributions to unfunded pensions and salaries for elected officials.

Jerod Walczak in an article for “The Tax Foundation” written on March 3, 2021, and updated May 27, titled “State and Local Aid In The American Rescue Plan Is 116 Times States’ Revenue Loss”, points out that the benevolent Congress may have overshot the real devastation by a significant margin. Most states with deficits had manageable losses in 2020. Here is Mr. Walczak’s estimate of actual losses for 2020 for some of the biggest population states:

California $6.127 billion In Estimated Revenues

Florida $2.634 billion In Estimated Losses

Illinois $443 million in Estimated Losses

Mass. $ 503 million in Estimated Revenues

New York $1.229 billion in Estimated Losses

Ohio $1.386 billion in Estimated Revenues

Texas $4.083 billion in estimated Losses

Here is a link to Mr. Walczak’s article to read projected fiscal outcomes for 2020 for all the states https://taxfoundation.org/state-and-local-aid-american-rescue-plan/.

Mr. Walczak also reminds us that approximately $319 billion was already allocated to state and local relief under preceding pieces of Covid-19 relief legislation culminating with The Cares Act in March 2020.

The allocation and distribution methodology for the $350 billion is summarized by Mr. Walczak as follows:

The good news is the “pork” panacea from ARPA provides about 100 times more than anyone needs. This should spur a line up of organizations trying to fund their WANTS from real and phony non-profits, to school systems and public venues and parks. Do you think the money may end up in some strange places?

As local responsibility for balancing budgets and spending within means goes awry, a whole new round of immediate gratification will likely ensue. States and local governments are being conditioned to spend beyond their means and join the rest of the world in a big, unfunded post pandemic party financed by a permanent drag on all future generations.

Coronavirus Relievers Are Like the Dodgers Bullpen

So far the Coronavirus relief has been like watching the Los Angeles Dodgers relief corps. Each successive reliever is bigger, stronger and more highly paid than the previous one, and they never seem to run out. Here is a summary from The Peter G. Peterson Foundation written on March 15, 2021, in an article titled “Here Is Everything The Federal Government Has Done To Respond To The Coronavirus So Far” Author WARNING: Tighten your jaw before viewing:

The irony of the endless aid is the worldwide supply chain is too dysfunctional to allow the money to end up spurring a recovery. Like the port of Los Angeles, the money just accumulates waiting for a chance to be unloaded. Meanwhile the mismatch of demand and supply is creating real inflation. Those who think we are in the 8th inning of the inflation game may be the same policy makers who think just sending more aid will jump start a recovery. Most disturbing is the endless cash is hindering a full employment workforce. Every small business is trying to hire but cannot compete with the printing press that, like the horn of plenty, never runs out. Unintended and intended consequences will be the story in 2022 and beyond.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.