For the last three months we have been so fixated on red and blue states we hardly noticed how many “black and blue” states are struggling from the pandemic’s onslaught. Unlike the Federal system where money printing of all kinds and deficit spending are accepted monetary policy tools, states are prohibited both from printing money and running annual budgets deficits.

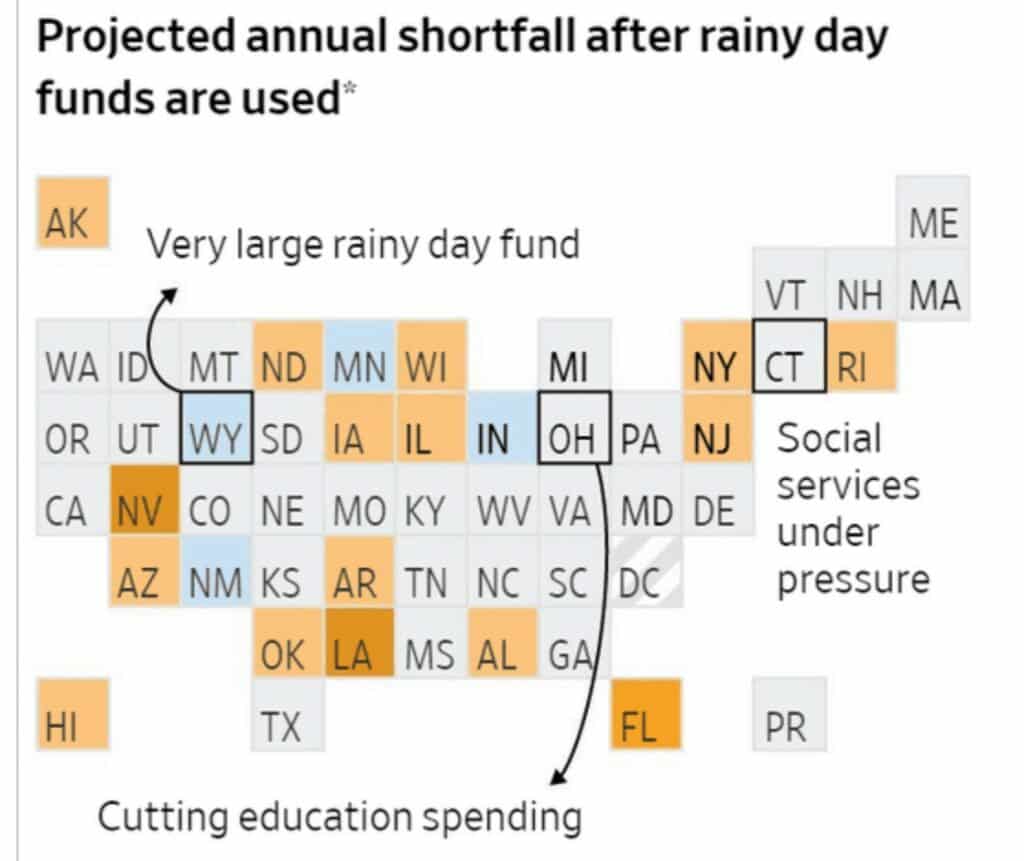

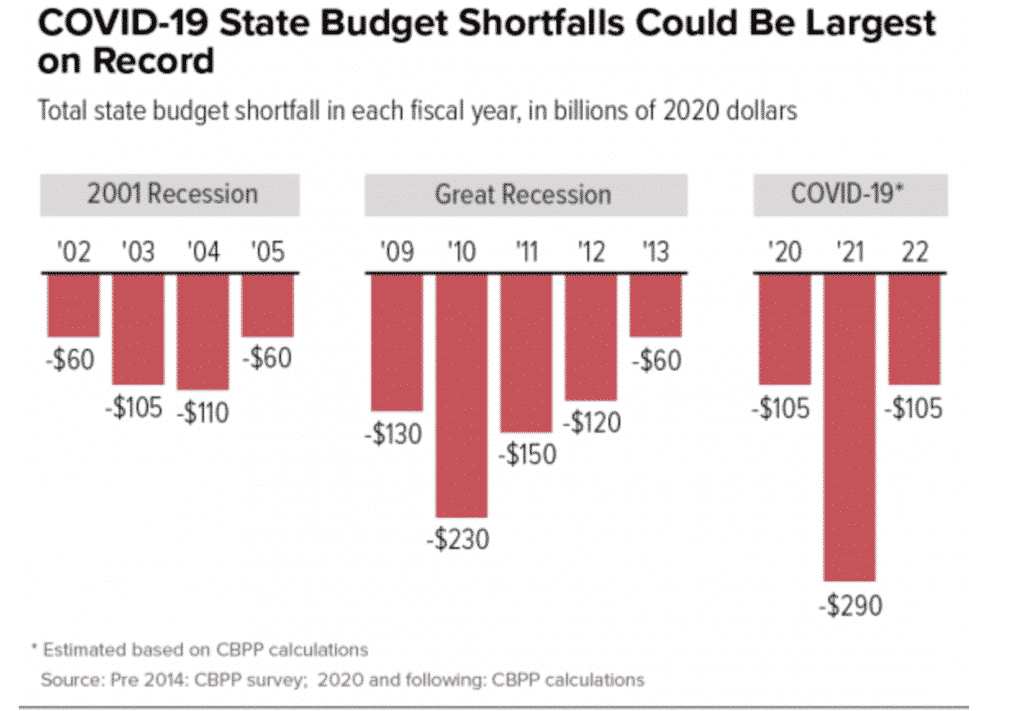

The situation is bleak, but fixable if we can form a consensus. The Center On Budget And Policy Priorities updated their projections on November 6, 2020. The two charts below show the 2020 budget projections both before and after “rainy day funds” have been used and spending cuts applied.

BEFORE RESERVES

AFTER RESERVES AND BUDGET CUTS

The real story will be 2021, when reserves are gone and citizens have reacted to increases in taxes, cuts in essential services, shuttering of schools and infrastructure needs. Here is a comparison of the state deficits from major economic reversals in my lifetime:

Here is also link where you can find the 2020 and 2021 projections for your state. For those of you who don’t want to know I will give you the top ten problem states (https://www.cbpp.org/research/state-budget-and-tax/states-grappling-with-hit-to-tax-collections). Without peaking, guess which states are in the worse shape?

Here are the top ten problem states in alphabetical order.

| State | 2021 Projected Revenue Deficit | Reason |

| Alaska | 15% | ENERGY |

| California | 17-21% | ALL SOURCES |

| Hawaii | 23% | TOURISM |

| Massachusetts | 9-31% | ALL SOURCES |

| Nevada | 26% | TOURISM/GAMING |

| New York | 17% | ALL SOURCES |

| Oklahoma | 26% | ENERGY |

| Texas | 15% | ALL SOURCES |

The Dollar Deficits are Substantial

Remember you cannot spend percentages, so the top 5 projected dollar deficits are pretty eye opening as well. It took me 21 state cumulative dollar deficits in alphabetical order from Alaska to Minnesota to equal California’s projected dollar deficit:

| State | 2021 Projected Dollar Deficit | Solution |

| California | $26.0 to 32.0 Billion | CUTS+TAXES |

| New York | $16.0 Billion | CUTS+TAXES |

| Texas | $8.0 Billion | CUTS+TAXES |

| New Jersey | $6.0 Billion | CUTS+TAXES |

| Massachusetts | $2.8-9.6 Billion | CUTS+TAXES |

Congressional Action Is Needed

There should be bi-partisan support for some measure of federal relief, but the gap between states with small deficits and large ones is problematic. Take the example of Georgia, where the balance of power in the U.S. Senate turns on two run-off elections in January. According to the November 6, 2020, update from The Center On Budget And Policy Priorities, some states like Georgia, Maryland and Florida have already made cuts:

“In Georgia, policymakers approved a 10 percent cut for 2021, including a nearly $1 billion cut for K-12 public schools and cuts to programs for children and adults with developmental disabilities, among others. Maryland enacted $413 million in emergency spending cuts including large cuts to colleges and universities. Florida’s governor vetoed $1 billion in spending that lawmakers approved before the crisis and ordered agencies to look for 8.5 percent more in possible cuts for fiscal year 2021. The state also cut money for community colleges and services related to behavioral health, including opioid and other substance use treatment services, crisis intervention services, and services for people experiencing homelessness.”

A Solution Will Revisit 1776 Large State/Small State Viewpoints

With the country split just about 50/50 on everything, and the possibility of Congressional gridlock, it will take incredible leadership to craft a funding solution. If responsible states are treated the same as irresponsible ones, this will be a repeat of the student loan forgiveness debate.

Should aid flow on the basis of the relative revenues of the states? That would mean high tax states would get more relief. Should it flow on the basis of the relative deficits? That would reward profligacy and punish states with balanced budgets. Should it just flow like a modern monetary policy river and wipe out all deficits? That might make sense if you could be assured that Covid-19 alone created the problem. Should it flow to states that made cuts to give them new rainy day funds?

Solomonic Wisdom and The Right Policy Response

This debate, more than climate control, abortion, taxation, immigration and socialism, will rekindle pioneer ideals of self rule and self determination at the state level. Based on freedom of choice and willingness to “vote with your feet”, freedom of movement has been an island of sanity for a polarized America. Many people have relocated to avoid punitive tax regimens.

Getting the right policy response is critical and it may be impossible in our gridlocked environment. The politicians may see it as a matter of red and blue, but for too may Americans it is really a “black and blue” experience that will certainly outlast the pandemic.