When the Israelites fled Egypt under Moses’ leadership they were constantly attacked by the Amalekites. In the valley of Rephidim the Israelites under the command of Joshua, met Amalek in a battle where Moses guaranteed his general a victory as long as Moses could oversee the fighting. According to the Book of Exodus, the Israelites had the better part of the battle as long as Moses held his arms in the air but the Amalekites would rally when he tired and dropped his arms. According to the Book of Exodus 17:10-13 the solution was some help from his family:

10 “So Joshua fought the Amalekites as Moses had ordered, and Moses, Aaron and Hur went to the top of the hill. 11 As long as Moses held up his hands, the Israelites were winning, but whenever he lowered his hands, the Amalekites were winning.12 When Moses’ hands grew tired, they took a stone and put it under him and he sat on it. Aaron and Hur held his hands up—one on one side, one on the other—so that his hands remained steady till sunset. 13 So Joshua overcame the Amalekite army with the sword.”

A modern-day reenactment of that battle is being waged on Wall Street as Jerome Powell and central bankers all over the world are battling for control of prosperity in all markets against obvious descendants of the Amalekites — banks, credit card companies, value investors short sellers, cryptos and owners of gold and silver. Chairman Powell has Stephen Mnuchin and Larry Kudlow holding up his hands and he is winning the fight.

Here are a few charts from The Wall Street Journal Daily Shot over the last few weeks predicting his staying power as well as demonstrating the enormity of his accomplishment given the lack of any fundamental attraction for many of his investments:

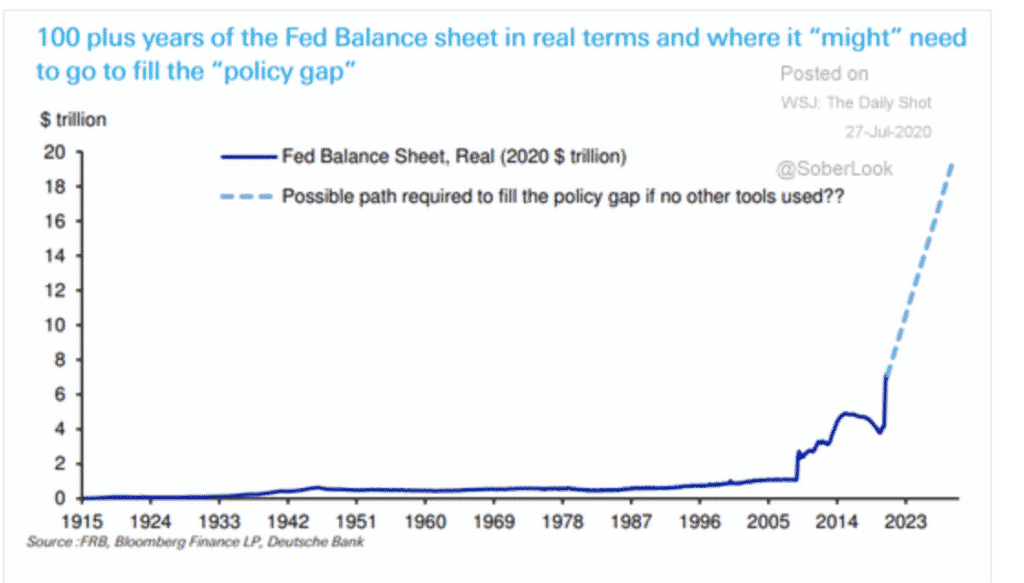

First, he has spent more money than Khloe Kardashian:

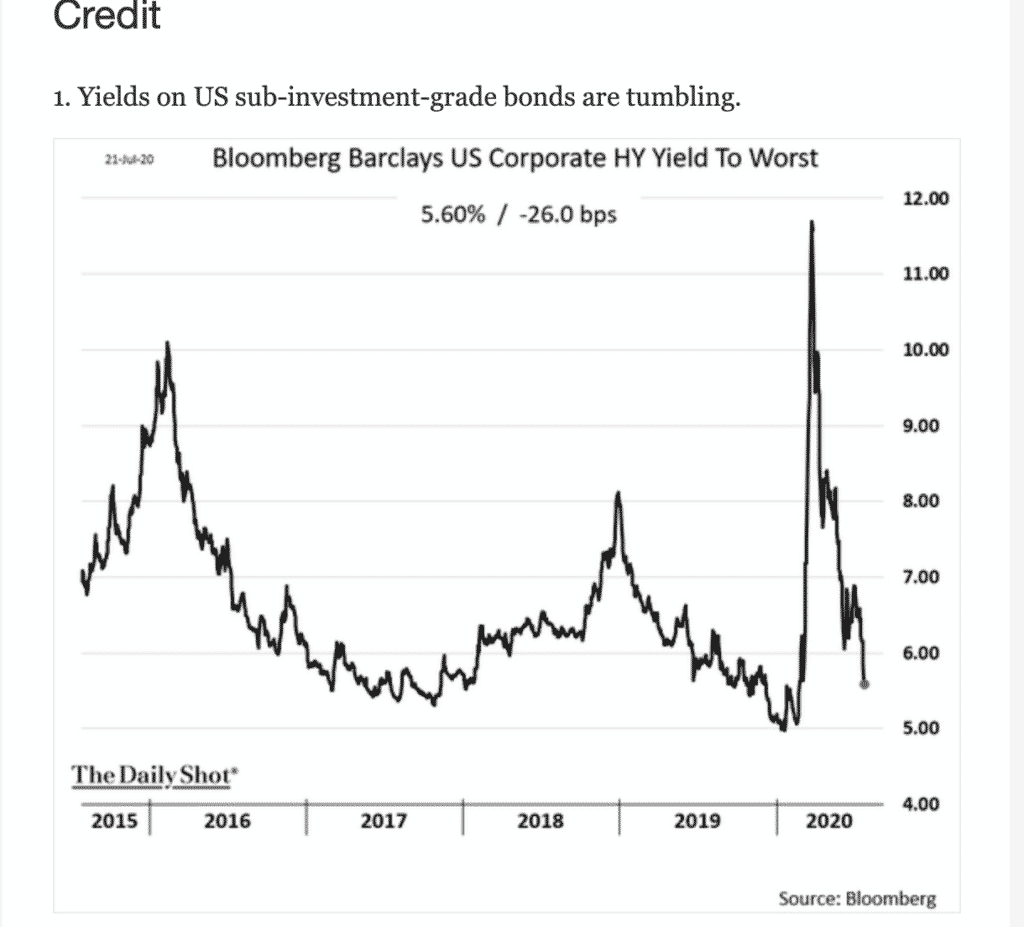

Next, he has tamed the exodus from High Yield:

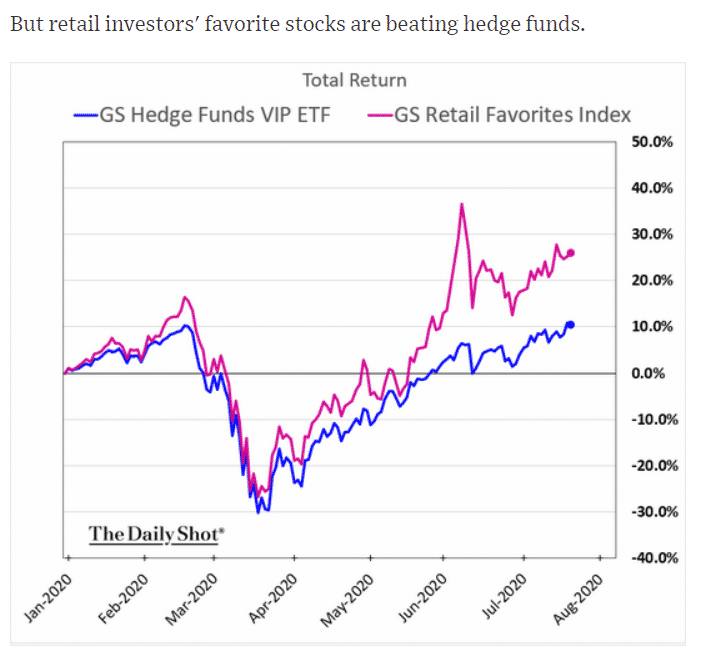

The day traders’ favorite stocks are beating the hedge fund managers:

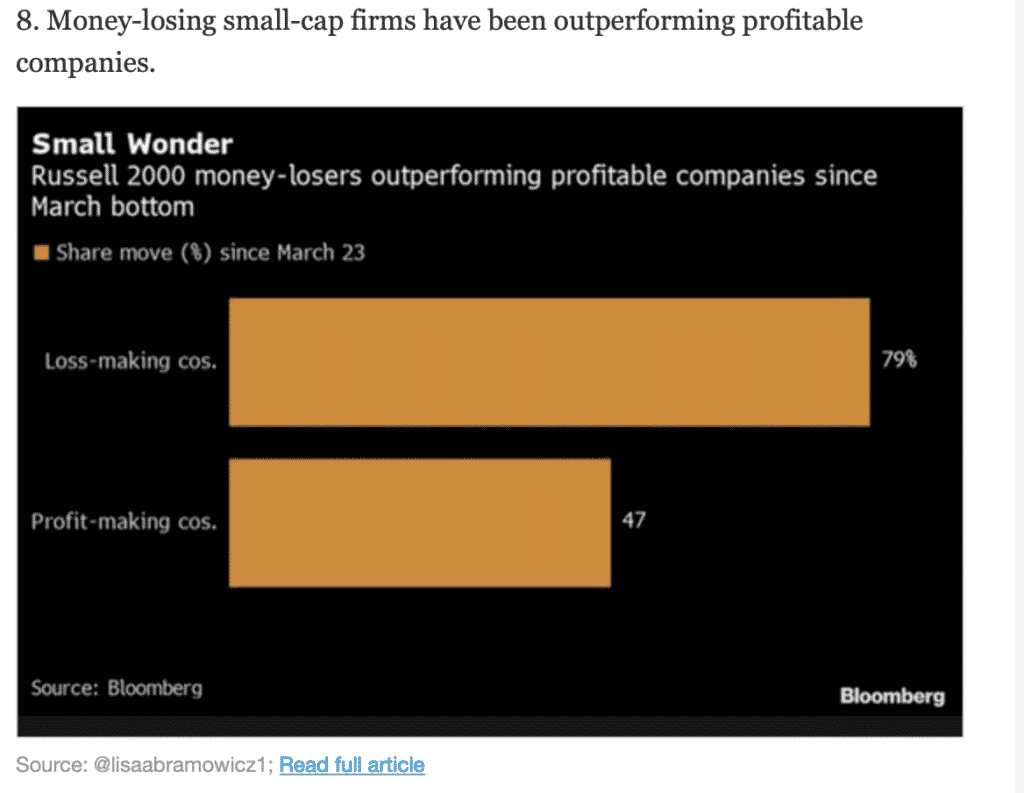

Zombie companies are performing best:

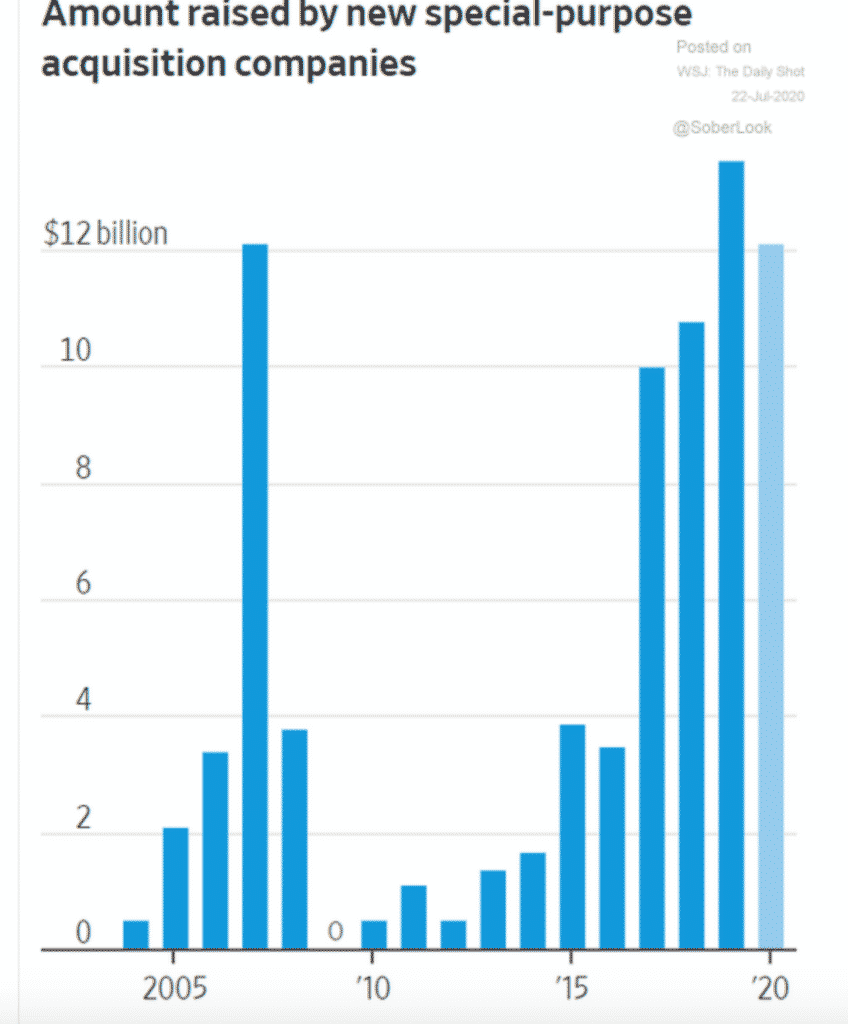

Public offerings for blind pool investment vehicles are booming;

Ironically, Mr. Powell appears to be fighting a war to restore an economic order that a Fed predecessor, Paul Volker, eradicated at great pains to the nation in the 1970’s and 80’s. Here is how an article by the NYT by Binyamin Appelbaum and Robert D. Hershey Jr., Published Dec. 9, 2019, Updated Dec. 13, 2019, described Volker’s economic battle and triumph over Amalekitic inflation:

“He prevailed by delivering shock therapy, driving the economy into a deep recession to persuade Americans to abandon their entrenched expectation that prices would keep rising rapidly.

The cost was steep. As consumers stopped buying homes and cars, millions of workers lost their jobs. Angry homebuilders mailed chunks of two-by-fours to the Fed’s marble headquarters in Washington. But Mr. Volcker managed to wring most inflation from the economy.

His victory inaugurated an era in which the leaders of both political parties largely deferred to the central bank, allowing technocrats to chart the course of monetary policy with little political interference.”

The Fed has come full circle in 50 years. We now desperately need inflation to relieve every heavily indebted asset class and prop up phony prosperity based on credit, not production, innovation or a current account surplus – all measures of a healthy economy.

Modern Monetary Theory has given money printing new license because we are told a country cannot default in its own currency as long as it has the power to print more. When you are the reserve currency for the entire world your flexibility is even greater. However, no one is asking whether this is prudent or even if this is legal?

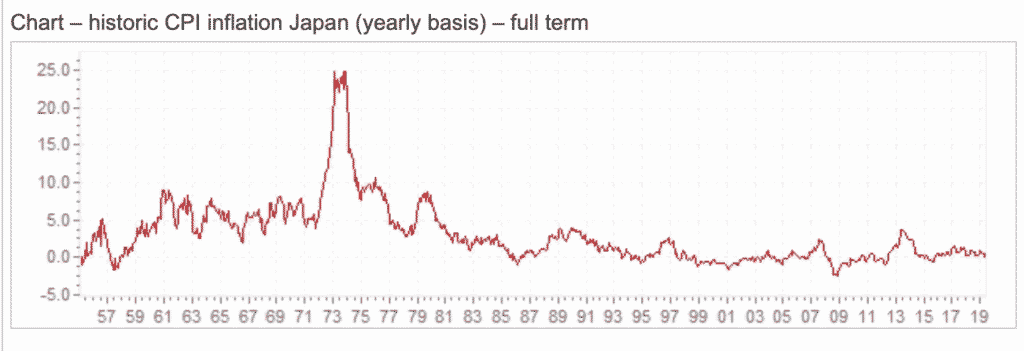

I wish I had the vision to understand where money printing will lead? You can look at Japan as a guidepost. They bought into Modern Monetary Theory early and they have printed with impunity. They have struggled to inflate their economy even after buying ETFs and propping up Zombie companies and insolvent banks. The Bank of Japan has had its hands in the air since the 1980’s and there is no sign of inflation. Here is a chart from Inflation.eu showing a deflationary pattern in Japan:

Just as Moses vanquished the Amalekites so, too, has Chairman Powell rewritten the rules for investment success. He is committed to defeating deflationary trends brought on by Covid-19’s destruction of jobs. As long as the markets are in his hands you cannot lose and there is no sign he is tiring.