I have written before about moon tides (and how they remind us about investment markets tending to exaggerate fear or greed) https://capitalworks.net/moon-tides/. Dangerous shoals are hidden when the tide is 20% higher and keels are in the mud or on the rocks when the moon tide has fully ebbed. But this part of nature is quite orderly and safe in most parts of the globe. You can predict with precision when the tides will turn and you have a period of hours to adjust your strategy. The average tides rarely exceed 3-4 feet.

For Most Times Markets Work Like Tides

Nonetheless, if you are in a kayak and you want to paddle against a rising or falling moon tide you better get an engine. If you want to fish at the bottom of a moon tide you better check the harbor to see if it has any water. The important thing is you have the knowledge and information to work with nature in most parts of the ocean.

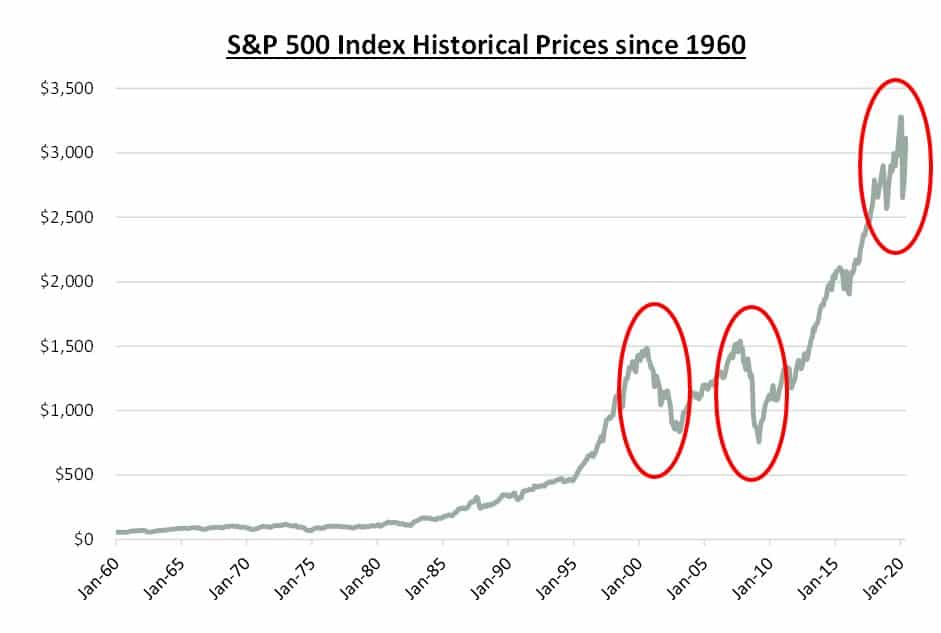

For most of my investment lifetime, investment markets have operated like tides. Fortunes ebb and flow as markets advance and retreat with almost harmonic oscillations. I experienced high tides in 1999, 2007, and 2019 and then low tides in 1974, 2000, 2008, and 2020. In 2020 the high tide was January, the low tide was February and March, and then the high tide returned in April through June. The market’s tidal harmony was interrupted by the Fed.

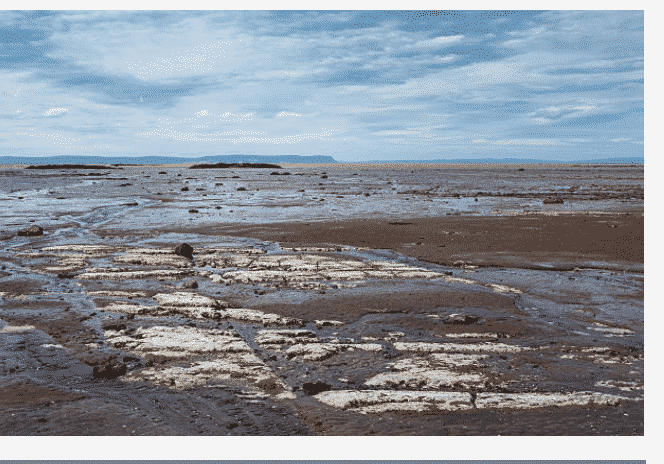

There are parts of the world, however, where the tides are epic – like the Bay of Fundy in Nova Scotia. It has more water flowing in and out of that Bay in one 12 hour period (100 billion Tonnes), than the flow in all the rivers of the world for the same period! They have moon tides as high as a five story building. The tides are so strong they can actually create tidal bores that stop the flow of rivers and create tidal waves of 10-12 feet.

The Fed Has Created A Permanent Bay of Funding

Jerome Powell and The Federal Reserve Bank are creating a special Bay of Fundy moment for markets all over the world by sustaining a perpetual 60 foot high tide. Of course, if you had to pick a tide (high or low) I would always take the high tide. It hides the rocks and shoals, puts nutrients in the water and traps baitfish for fantastic fishing and permits navigation into corners of the coastline where you have never been. But after a few days it begins to create distortions for small craft like sailboats, dinghie’s, kayaks, and paddle boards. They all forget about risk.

You can always catch fish. You can always move from place to place by water. You can always navigate tidal rivers. You never have to swim against the tide. You begin to rely on the permanent flow often forgetting how different life is at low tide and how recently it just occurred.

A Worldwide Liquidity Crisis

In March of 2020, the Fed adopted emergency measures spawned by Modern Monetary Theory to create the first ever perpetual moon tide.

The reason was market liquidity was receding fast and the world economy was about to be left high and dry from a natural pandemic that halted worldwide commerce and crippled GDP. There simply was not enough liquidity in any market anywhere to handle the massive outflows from a leveraged world scrambling for cash.

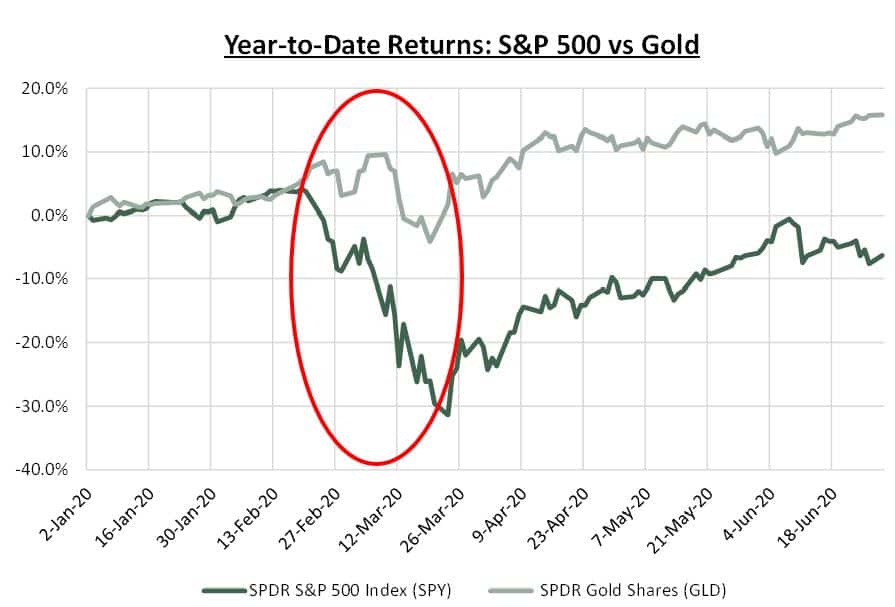

Some of those really strange things were the highest quality bonds in the world started to trade like junk, and gold was crashing just like the stock market.

For example on February 19, just as the implications of Covid-19 were being digested, the price of the gold index, GLD, was 151.19 and the price of the S&P 500 index, SPY, was 338.34. On March 6 , when the enormity of the crisis was being recognized, GLD was 157.55, a 4.2% increase and SPY was at 297.46, a 12.08% decrease. This inverse relationship is what you would expect. But then on March 19, GLD was at 138.04, a 8.6% decrease from February 19. The SPY was at 240.51 on March 19, a 28.9% decrease from February 19.

Some short duration high quality bonds such as Apple and Wells Fargo saw their yields spike and their trading prices plummet. If Apple with the largest equity market cap in the world and billions of cash on its balance, was trading at massive discounts because investors were desperately trying to raise cash, the capital markets were about to disintegrate (see graphs below).

Source: Wasmer Schroeder

The Fed Turned The Tide

Prior to February 2020, massive capital inflows fueled by dirt cheap leverage sustained a whole swath of high risk assets like Zombie corporations, high yield bonds, collateralized loan obligations and questionable municipal credits. Portfolios picked for yield with excessive principal risk were commonplace. Investors and speculators alike thought they had boarded the SS Vanguard, Blackrock, and Fidelity on a coming tide and what they really owned was a flotilla of leaky kayaks sitting in the Bay of Fundy just as the liquidity tide was starting to go out!!!

That flotilla is still there enjoying a perpetual high tide from the Fed’s “Bay of Funding”. They are recently joined by Gilligan, Skipper, Mary Ann and Ginger and a whole boatload of day traders who think they are on a three hour cruise.

We know how it ends for the SS Minnow, but for those of you who don’t understand the meaning of no liquidity, here is what is left when the Bay of Fundy empties after a Moon Tide. We better hope the Fed can sustain this high tide until the economy gets back on track.