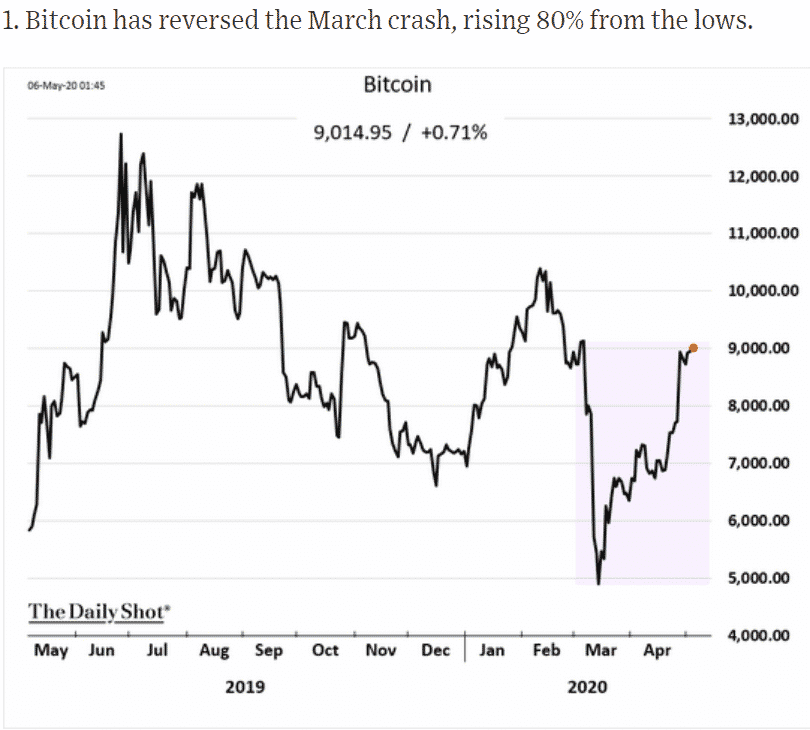

College friends are brutally honest. So, it came as no surprise to me in a Zoom cocktail chat with former classmates over the weekend there was some curiosity but even more suspicion, about Bitcoin’s recent price rises. Here is BTC’s chart over the two years from the May 6, 2020, “The Daily Shot”.

I called my classmate/ detractors “luddites” and assured them Bitcoin is highly relevant in the time of Coronavirus for the following reasons:

- Central Banks all over the world are running their printing presses at a rate everyone knows will result in “unpayable debt”.

- There is no difference between Bitcoin and any other currency—none of them is backed by anything tangible- just trust and confidence.

- Emerging countries who print money in their own currency, but owe creditors in a currency other than their own, like Argentina, Venezuela and Brazil, risk hyperinflation.

- Crony capitalism is destroying the full faith and credit pledge—it only seems to be working for a small group of insiders.

- Bitcoin is the easiest way to move capital out of a country anonymously.

- The blockchain on which BTC is based has never been manipulated by insiders or outsiders.

- The guardians of the blockchain are paid in Bitcoin.

- The pledge of scarcity is being fulfilled this month by the third “halvening”.

Central Banks Are Printing

According to Jeff Booth, author of “The Price of Tomorrow” (here is the YouTube link), the latest “C-19 Recession” reveals a current world economic order where central banks over the last 20 years have created $185 trillion of debt to support annual worldwide increases in GDP of $46 trillion. That is almost $5.00 of debt to produce $1.00 of GDP, and it seems like a bad trade-off, especially when the major winners are people who already have capital.

Bitcoin’s constitution limits the number of Bitcoin to $21 million. That number will be in circulation in 2140 after which no more Bitbcoin will be created. Right now, there are slightly more than $18.3 million in circulation and the pace at which they are being created will be “halved” on May 11, 2020 for the third time since Bitcoin was created.

No one person, group of people or external authority can change blockchain’s constitution unless a cartel is formed controlling more than 51% of the coins incirculation. So far there have been “forks” where groups have split off from Bitcoin ( like a new religion), by forming a new constitution around ideas like expanding the coins in circulation, but no one has taken control of Bitcoin. This is a risk and there are several large miner groups in China and one dominant dealer in the US..

The US Dollar and Bitcoin Are Not Backed by Anything

In 1971 the United States abandoned the gold standard under which 25% of all new issuances of money had to be backed by physical gold in the US Treasury. By abandoning the gold backing, Nixon ushered in a new era of central bank monetary policy. The US Dollar has held up as the world’s reserve currency since Bretton Woods in 1943 and there is no other currency that threatens the USD’s hegemony right now. But understand the USD is only as safe as people’s confidence in it.

This is exactly why Bitcoin will continue to compete with the USD. They both are based on confidence, but right now you can’t easily buy pizza with Bitcoin. This is not a flaw in BTC’s design- one BTC can be digitized to 0.00000001 (a “Satoshi”). Rather, the dollar is an accepted medium of exchange and is a better world currency than the Swiss Franc (low circulation), the Chinese renminbi (no transparency), or the Euro (weakest link member problem).

Capital Flight Urgency May Elevate BTC’s Standing

If you wanted to get capital out of China in 2017 when its government created strict “capital flight” restrictions, you literally risked your life unless you could be invisible and anonymous. These weren’t criminals hiding drug money. These were citizens and businesses in China using bitcoin to anonymously move capital to safer harbors. Similarly, if you are a citizen in Venezuela, Argentina or Brazil in 2020 experiencing the early innings of hyperinflation where their local currencies are in the process of being debased by 10x or more, you would find BTC to be a suitable alternative. It is more anonymous and portable than gold or silver. The 20-30% swings in the trading price of BTC which currently hinder its utility as a currency will likely be just fine with Venezuelians, Argentines and Brazilians when a loaf of bread costs rises from 20 cents to $1.40.

Peer to Peer Networks Are an Antidote to a Crony Kleptocracy

Increasingly, the central bank systems around the globe are built on a “who you know” or “who’s your lobbyist”. The winners are those who take huge risk with leveraged bets, but get bailed out every 10 years in a crony kleptocracy. To my knowledge there is no visibility of who benefited in March and April 2020, from the Fed’s latest round of monetizing private assets, including Exchange Traded Funds that had lost their value.

Under Bitcoin the currency is an open book that is verified with every transaction through the blockchain. There is a limited amount of BTC in circulation and no outside influence can debase the value of BTC by printing more. A world order based on a currency that cannot be manipulated for the benefit of a few will likely be much desired in coming years.

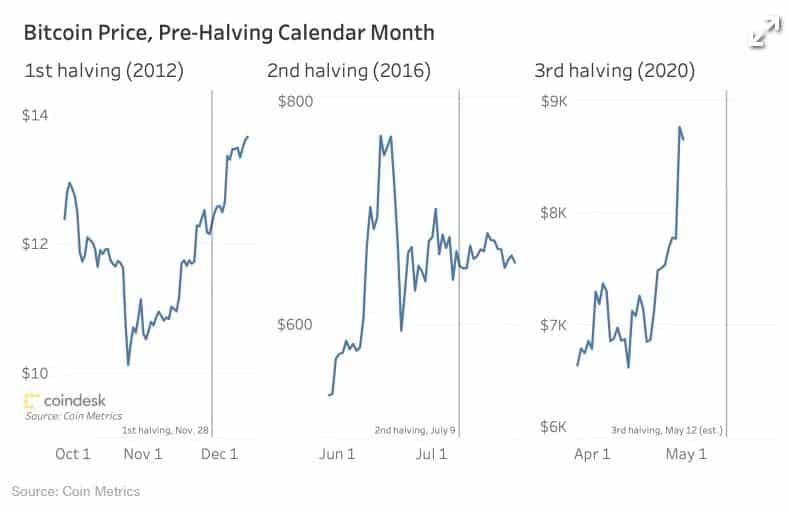

Scarcity Is Happening This Month With the Third Halving or “Halvening”

Effective May 11, Bitcoin is cutting in half the reward it pays its miners for validating the blockchain. This payment mechanism is the only method by which new BTC is put in circulation. According to the May 6, 2020, “The Daily Shot” here is the history of the first two “halvenings” and the prelude to the halvening set to occur on May 11:

Given the competing central bank regimen of unlimited “do whatever it takes” money printing, this built in restraint on the supply of Bitcoin may be viewed as unique.

No Panacea but Getting More Attractive Every Day

The future of Bitcoin is still pretty uncertain, but its relevance as digital gold and a transporter of wealth in capital flight situations is becoming more mainstream. If the central banks lose the wheel and world economies run off a cliff, Bitcoin may be in the mix as a strong replacement candidate for the next reserve currency.